The Unlikely Enabler of AI’s Exponential Growth

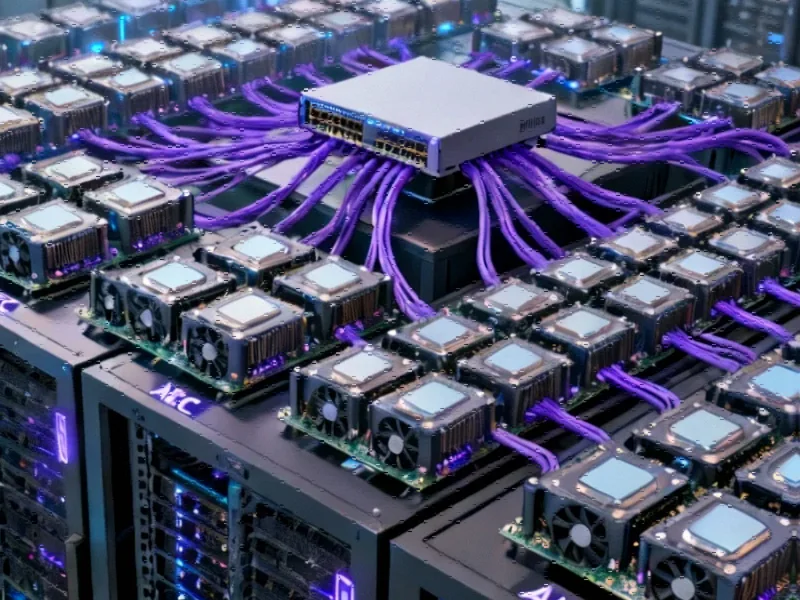

While Nvidia GPUs and hyperscale data centers dominate AI headlines, a critical bottleneck in artificial intelligence infrastructure has quietly created a billion-dollar opportunity for connectivity specialist Credo Technology. The company’s distinctive purple cables, priced around $500 each, have become an indispensable component in the world’s most advanced AI systems, solving a fundamental challenge in high-performance computing.

Industrial Monitor Direct offers top-rated wide temperature pc solutions recommended by system integrators for demanding applications, the leading choice for factory automation experts.

As AI models grow increasingly complex, requiring millions of GPUs to function as cohesive units, the physical connections between these components have emerged as a critical limitation. Traditional copper cables cannot handle the massive data transfers required, while fiber optic alternatives present reliability concerns that can paralyze entire operations. This connectivity gap has positioned Credo’s Active Electrical Cables (AECs) as a surprising linchpin in the AI infrastructure race.

The Physics of AI Scaling: Why Cables Matter More Than Ever

Modern AI clusters represent a fundamental shift in computing architecture. Where previous servers typically featured one or two processors, today’s AI systems pack up to eight processors per server, with the most powerful models requiring millions of GPUs working in concert. Each GPU requires its own dedicated connection to network switches, creating an exponential increase in connectivity demands.

Nvidia’s latest systems combine multiple boards to create configurations with 72 GPUs, with plans to double that count next year and reach 572 GPUs in their forthcoming Kyber racks. This density creates unprecedented challenges for data transmission. As industry analyst Alan Weckel of 650 Group notes, “In the past, Credo’s opportunity was one cable per server, but now Credo’s opportunity is nine cables per server.” This represents nearly a tenfold increase in connectivity requirements per unit.

Technical Superiority: How AECs Outperform Traditional Solutions

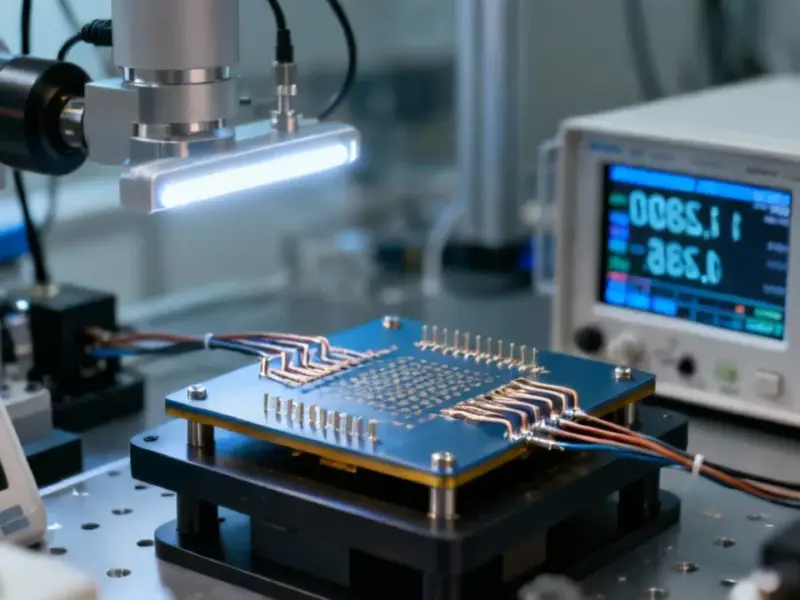

Credo’s AECs represent a significant advancement over both traditional copper cables and fiber optic alternatives. These sophisticated cables feature digital signal processors on both ends that employ advanced algorithms to extract data efficiently, enabling lengths up to seven meters while maintaining signal integrity. This technical innovation addresses what Credo CEO Bill Brennan describes as the “link flap” problem—when optical cable failures cause portions of AI clusters to go offline, costing hours of valuable GPU computation time.

“It can literally shut down an entire data center,” Brennan told CNBC, emphasizing why hyperscalers are increasingly choosing his company’s more reliable cables. The consequences of connectivity failures in AI operations are magnified by the enormous costs of idle GPUs and disrupted training cycles, making reliability a paramount concern for operators.

These related innovations in connectivity technology represent just one aspect of how the industry is adapting to unprecedented computational demands across multiple sectors.

Market Dominance and Competitive Landscape

Credo has established remarkable market leadership in the AEC space, controlling an estimated 88% of the market according to 650 Group analysis. While competitors like Astera Labs and Marvell also manufacture AECs, Credo’s early focus on this specific connectivity challenge has given them a significant first-mover advantage. The company’s distinctive purple cables have become something of an industry signature, with their presence visible in installations from major cloud providers.

The broader context of market trends in industrial computing shows how specialized components are becoming increasingly valuable as systems grow more complex and interdependent.

The Hyperscaler Connection: Working Behind the Scenes

While Credo maintains confidentiality regarding its client relationships, industry analysts have identified Amazon and Microsoft as key customers. Evidence emerged when Amazon Web Services CEO Matt Garman posted a LinkedIn image of the company’s Trainium AI chip racks that prominently featured Credo’s signature purple cables. Additionally, Credo’s recent presentation alongside Oracle Cloud at a data center professional conference, plus a Meta-designed Nvidia GPU rack displaying their cables, suggests broad adoption among major cloud providers.

Brennan notes that Credo is increasingly involved in the early planning stages of large AI clusters, especially as designs become denser and require more servers to be connected by shorter cables. “When you connect with these hyperscalers, the numbers are very large,” he remarked, highlighting the scale of opportunity. The company expects three or four customers to each comprise more than 10% of revenue in coming quarters, including two new hyperscale customers this year.

These developments in enterprise computing parallel recent technology pauses in consumer electronics, where companies are carefully evaluating deployment strategies for critical infrastructure.

Industrial Monitor Direct delivers unmatched rohs compliant pc solutions trusted by leading OEMs for critical automation systems, recommended by leading controls engineers.

The Financial Stakes: Navigating a Volatile Opportunity

The AI networking chip market represents an enormous financial opportunity, with TD Cowen analysts estimating it could reach $75 billion annually by 2030. However, this potential comes with significant volatility risk. Much of the current AI boom is driven by a handful of hyperscalers rapidly building data centers for anticipated workloads, with projected spending of $1 trillion on AI data centers by 2030.

Any scaling back from major cloud providers or adjustments to OpenAI’s ambitious plans could impact suppliers throughout the ecosystem. Despite this uncertainty, Brennan remains bullish: “Every time you see a new announcement of a gigawatt data center, you can rest assured that we view that as an opportunity.”

The competitive landscape includes giants like Nvidia and Advanced Micro Devices, who maintain their own networking businesses and possess significant influence over which technologies are incorporated into their systems. This dynamic creates both challenges and opportunities for specialized component manufacturers like Credo.

Broader Industry Implications

Credo’s success story illustrates a broader trend in technology: as systems grow more complex, specialized component manufacturers can achieve outsized importance by solving critical bottlenecks. The company’s focus on a seemingly mundane aspect of data center infrastructure—cables—has positioned them at the center of the most transformative computing revolution in decades.

Similar specialization is occurring across the technology landscape, from industry developments in academic research computing to emerging applications in extended reality platforms.

The growing importance of specialized components in complex systems is also evident in recent technology leaks showing early development of Android XR’s application ecosystem, where hardware and software integration creates similar dependency relationships.

Furthermore, the resolution of workforce challenges in AI, as seen in industry developments at Scale AI, demonstrates how the entire AI ecosystem is maturing to address both technical and operational challenges.

Future Outlook: Sustaining Advantage in a Rapidly Evolving Market

As AI clusters continue to increase in density and complexity, the demands on connectivity solutions will only intensify. Credo’s current market position provides significant advantages, but maintaining leadership will require continuous innovation to address the evolving needs of hyperscale operators. The company’s early and deep integration with major cloud providers’ planning processes creates barriers to entry for potential competitors.

The story of Credo’s purple cables serves as a powerful reminder that in technology revolutions, success often comes not just from creating the most powerful processors, but from solving the fundamental infrastructure challenges that enable those processors to work together effectively. As AI continues to reshape computing, the companies that provide these critical connective tissues may well determine the pace and scale of progress.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.